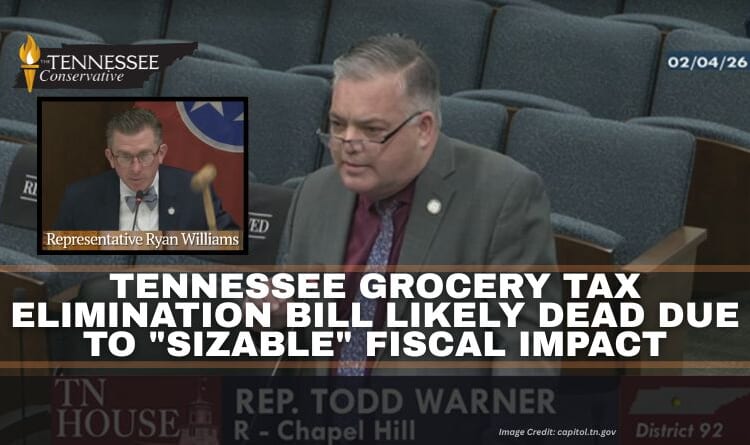

Image Credit: capitol.tn.gov

The Tennessee Conservative [By Paula Gomes] –

A Tennessee grocery tax elimination bill was placed behind the budget in the House Finance, Ways, and Means Subcommittee on Wednesday meeting the same fate as a similar bill last year.

House Bill 1530 (HB1530) sponsored by Representative Todd Warner (R-Chapel Hill-District 92) aims to exempt food and food ingredients from state sales tax.

Tennessee is one of just ten states that taxes groceries. Consumers pay 4% in state taxes and local governments are allowed to add up to 2.75% if they so choose.

Warner’s bill would repeal the state’s portion of the tax beginning July 1st but local governments could still set their own grocery tax.

Despite GOP leadership saying last year that they are committed to addressing the issue, the bill was quickly dismissed due to what Committee Chair Ryan Williams called a “sizable” fiscal impact.

Knowing the fiscal note would likely stymie the bill, Warner pointed out that the state would not lose the whole of the tax revenue.

“Statistics show that when we put money back in the pockets of taxpayers, they have a tendency to spend it on other things,” said Warner.

Williams stated, “In order for that bill to be funded we’d have to cut services somewhere else.”

When The Tennessee Conservative reached out to Warner yesterday evening to ask what he thought about the likelihood of the bill being funded this year, he didn’t hold out much hope, saying it probably would not happen.

About the Author: Paula Gomes is a Tennessee resident and reporter for The Tennessee Conservative. You can reach Paula at paula@tennesseeconservativenews.com.