Image Credit: John Partipilo

By Adam Friedman [Tennessee Lookout -CC BY-NC-ND 4.0] –

Unlike in previous years, when Tennessee’s coffers were flush with cash, the state budget will likely play a much more central role in this year’s legislative session as Gov. Bill Lee proposes spending down cash reserves for more business tax cuts and his school voucher proposal.

On Monday, Lee delivered his $52.6 billion budget proposal to lawmakers, a $3 billion smaller budget proposal than last year.

This lack of money means the Lee administration is not proposing any sales tax holiday — like they did the last few years — but still wants to push through its vouchers plan (costing $145 million), franchise tax cut ($410 million) and a one-time business tax refund ($1.1 billion).

To explain this year’s budget crunch, the Lookout has created three charts to better detail what is happening with the state’s spending and revenues.

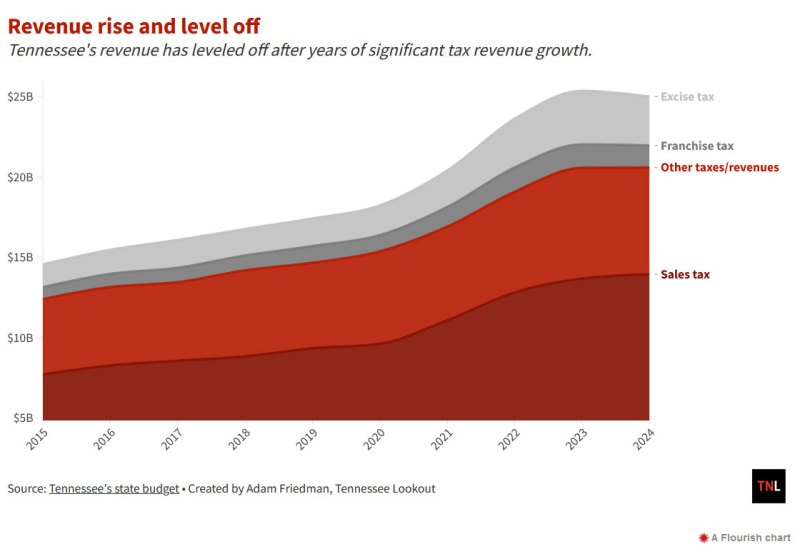

Slowing down

During his State of the State address, Lee touted Tennessee’s budget growth during his time in office and cited his administration’s “conservative approach” to ensuring officials prudently spent the new money.

As the chart below shows, most of that tax growth came in years following the 2020 coronavirus pandemic when the U.S. economy was soaring partly due to stimulus funds passed by Republican and Democrat presidents.

But last year the growth slowed down. Officials expect sales tax collections to rise, but not as fast. Meanwhile, the state’s business taxes — franchise and excise —also grew at a fiery pace during the pandemic but are set to fall this year after the state passed a significant tax cut for corporations.

Money pours into education, TennCare, tax cuts

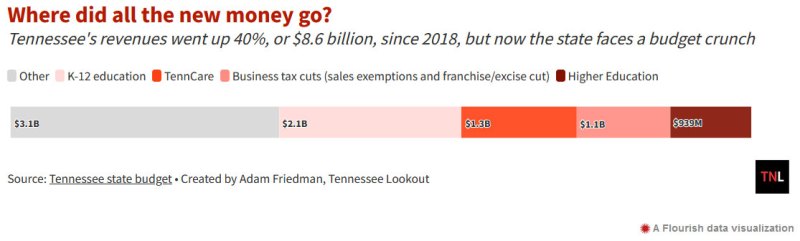

All the increases in tax revenues resulted in the state getting $8.6 billion more in last year’s budget compared to 2018.

Lee and lawmakers have quickly spent that, as the chart below shows. Of the total increase, $5.5 billion has gone into increased spending for K-12 and higher education, TennCare and an increase in business tax cuts through sales tax exemptions and last year’s business tax cut.

The rest of the money has gone into various departments to cover salary bumps and production cost increases caused by inflation.

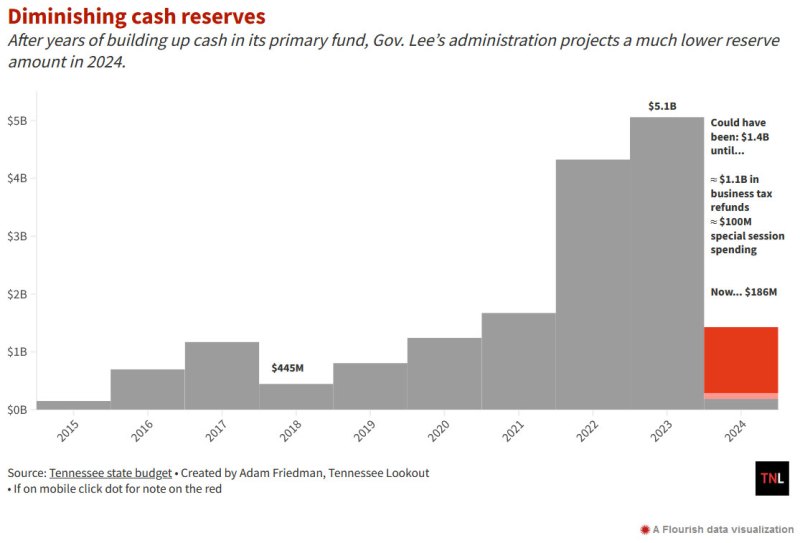

Room to maneuver… for now

Adding new spending and tax cuts worked fine for Tennessee until this year. With revenues no longer growing, state officials had to dip into the cash reserves in their primary and education funds to back new initiatives.

Last year’s budget proposal contained over $5 billion in these reserves, while this year’s leaves it at $186 million.

The state budget was initially supposed to have $1.4 billion in reserves. But, as the chart below shows, spending during the August special legislative session and a $1.1 billion business tax refund would result in that fund reaching its lowest point in nearly ten years.