HERE’S a quiz question: Where is the centre of Great Britain? The answer is Whitendale Hanging Stones, about 13 miles from our Lancashire village, as calculated by the Ordnance Survey.

The nearest habitation is the hamlet of Dunsop Bridge, four and a half miles south.

It is at the entrance to the spectacular and hardly known Trough of Bowland.

Dunsop Bridge is famed for its large number of mallards, and this picture shows some of them lazing on the green in front of the bridge from which the village takes its name.

They must be the most fortunate ducks in the country as they are fed from dawn til dusk by visitors. Once we found a huge flock of chaffinches on the green, also eager to be fed. There must have been a hundred or more, but we have never seen them again.

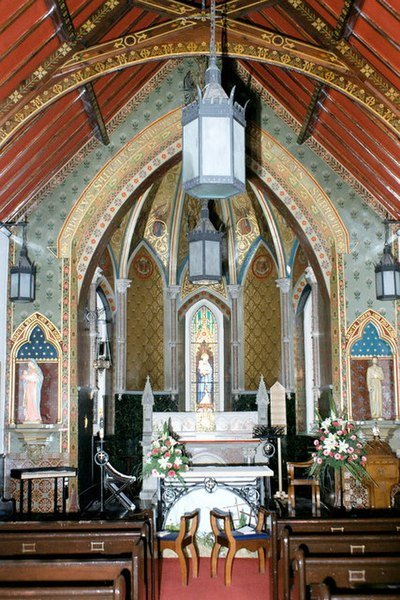

To be brutally honest, I have seen prettier villages. However it does boast one jewel, the Roman Catholic church of St Hubert.

It was designed by Edward Pugin (1834-1875), son of Augustus Pugin who designed the Palace of Westminster and Big Ben. Edward Pugin took over his father’s practice and by the time of his early death at the age of 41 he had been responsible for designing more than 100 Catholic churches.

St Hubert’s was opened on May 2 1865. It was funded from the winnings of a racehorse called Kettledrum, which was owned by Colonel Charles Towneley of Towneley Hall, Burnley. The Towneley stable was at Root Farm, Dunsop Bridge. Kettledrum won the Derby in 1861, and came second in the 2,000 Guineas and the St Ledger. (You can read more here about the horse, after which the Kettledrum Inn at Cliviger near Burnley is named.)

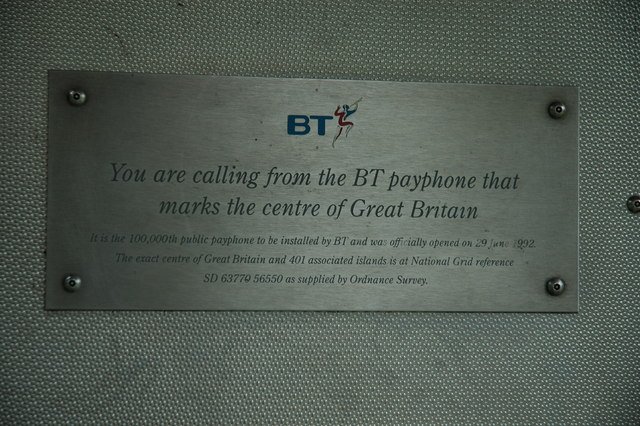

Another historic construction is BT’s 100,000th telephone box which was opened by explorer Sir Ranulph Fiennes on June 29 1992, after the village was named the closest to the centre of the British Isles. BT included a commemorative plaque to explain its significance.

It was spared in the mass closure of telephone boxes after mobiles came in.

These symbols are carved into a wall.

I was mystified until I found out that it is a benchmark, an old-fashioned aid to surveyors enabling them to site their measuring instruments in the same place every time.

And I found this picture of a stream near the village which has a pass to help eels on their migration. (I wrote about eels and their extraordinary journeys here.)

Footnote: The title of geographic centre of Great Britain is also claimed by Haltwhistle in Northumberland, 71 miles to the north. This is because it is 290 miles from Portland, Dorset (south coast) and 290 miles from North Orkney (north); 36.5 miles from Wallsend (east coast) and 36.5 miles from Bowness on Solway (west coast). The Ordnance Survey explain here how they come up with Whitendale Hanging Stones.

***

Goat of the Week

THIS gorgeous creature is an Angora goat, and here are a flock of them.

It is the hair from these goats which is made into mohair. This is not goat hair as seen on other breeds, but the down or undercoat which grows much longer than the outer hair coat. The younger the goat, the finer the hair. They are shorn twice a year.

Most authorities say the breed originated in Turkey and got its name from the old spelling of the capital, Ankara. However the British Angora Goat Society gives a detailed history and says goats with long wavy ringlets were known in Old Testament times, thousands of years ago, in Ur of the Chaldees, which is in present day Iraq. In the 13th century AD animals were trekked thousands of miles, a little each day, to Turkey. There the name ‘mohair’ was given to the fleece, being derived from the Arabic word ‘mukhaya’ meaning ‘cloth of bright and lustrous goats’ hair’ (what a very economical language it must be).

Spun mohair reached Britain around 1600. In Victorian times demand from around the world was so high that the Turks started crossbreeding the Angora goats with Kurd goats, nearly wiping out the pure-bred animals and resulting in inferior fleece. Luckily some pure-bred Angoras had already been exported to South Africa and later some were sent to Texas and Australia. These countries are now the centres of mohair production.

In the 20th century Bradford in Yorkshire processed a large proportion of the world’s yarn. The BAGS says:

‘The presence of the Bradford mills as a market for the produce prompted breeders to consider importing angora goats into Britain in 1980 when the farming community needed good alternative forms of diversification . . .

‘The first Texan angoras arrived in 1987 and since those early days South African bloodlines have also arrived . . .

‘With sound breeding expertise aimed at optimising the characteristics of these different genetic sources a British angora goat has been evolving over the past 20 years that now compares favourably with its Texan, South African or Australian counterpart.

‘There are now approximately 5,000 registered angora goats in Britain, with up to 3,000 more unregistered animals. Most of these are kept in small flocks by enthusiastic breeders, but some larger commercial flocks are starting to emerge.

‘The animals have settled well into a completely different environment, showing the adaptability for which the goat is noted.’

Here is a delightful film from North Wales.

And this is from Michigan, US.

You can find out more at the British Angora Goat Society website. I was sorely tempted by the advert headed ‘Lady Goats Looking For A Retirement Home’.

***

Wheels of the Week

This week guest writer DAVE HIPPERSON takes on the motor insurance companies.

WE MAKE claims or change insurance companies relatively infrequently. The operative on the phone however might be dealing with this situation 30 times a day and is versed in every twist possible in the system. We are novices baffled by their jargon.

It is commonly accepted that this system is a one-way valve. If you are the slightest bit late with a premium your policy is void yet when you make a claim money the company invariably find a myriad ways to delay you and often a way for you to fail altogether. It is legalised extortion, endorsed by government and made compulsory.

Failure to insure is a criminal offence, and the companies are well aware of this. They have a free hand to charge pretty much whatever they like. With a bit of collusion, they can stitch the market up nicely pushing premiums as high as they like.

Take the case of a gentleman (me in this instance) with a vehicle properly insured with a reputable firm and nine years NCB. He buys a second, a smaller and less powerful vehicle, and phones them to add it to his existing policy.

No, they can’t do that. Sorry, they can’t do what?

The company won’t offer him a policy to cover two or more vehicles and as for a reduction (since he can’t drive both at the same time), they haven’t even heard of anything like that. Something that a few years ago was very common; I know as I did it many times. The gentleman has to start again with an entirely new policy and thus no NCB. This is a man that they have registered as having made no claims for dozens of years and has no convictions. He is already insured with them and it’s the man that makes the claim, not the car, so it’s illogical. His current annual insurance premium is £650; they quote a premium on this new smaller car of £1,200 with no NCB.

The gentleman has been driving for 60 years, and his last claim was so far back he has forgotten when and for how much – very possibly he has never made one! He would have to start another no claims bonus staircase for this new car. Therefore he opts to change the cars on his existing policy, meaning the old one will be uninsured as soon as he takes possession of the new one. That’s awkward as the old one is an un-saleable Hyundai i20, in immaculate condition but which starts only intermittently, sitting outside his house.

The operative explains that there will be an adjustment when he renews bearing in mind it’s a different car and in the meantime there is a handling charge for this paperwork shuffle of £47.

The insurance deal is completed. As it happens the Hyundai started a few more times and behaved itself long enough for it to be traded in against the new purchase, so not too much money was lost and no vehicle was left illegally uninsured. (I still feel somewhat guilty palming it off on to a dealer who might discover tomorrow that it won’t start but he was the one that sold it to me in the first place and from whom I bought the smaller cheaper replacement.)

However the game (agony) was by no means over. In fact hardly started.

The renewal came a month later. It was for a staggering £1,200. That was twice the current premium and for a slightly smaller and less valuable car but worse. It was the same as the same company had offered me if I were to start a new policy with no NCB.

I emailed my query as I knew I would blow if I phoned, and if it is in writing it can be referred to later. My query was how could my premium have doubled in four weeks to the premium I was being offered with a non-existent NCB. Fishy in the extreme.

After some exchanges I got this from them:

Dear Mr Hipperson,

If you had of taken a new policy for the new vehicle this would have been a second policy which is why I mentioned it to you. I was explaining the new annual Jaimi quoted included a second car discount.

I am unable to provide you with any further explanations on premium increases than I have already.

Kind Regards

Johanne

It is almost pidgin English. Notice they suddenly mention a second car discount which was my suggestion and one they had flatly refused at the time of applying. Clearly they are totally befuddled by someone who asks logical questions.

I got on to the AA with whom I have a breakdown membership and via the Co-op I managed to get the premium down to £650 again. Still far too high but much better. However this was not without considerable time spent filling in a massive online form. I joke about bureaucratic needs to prove identification by asking for such nonsense as inside leg measurements and mother’s maiden name and such – on this occasion this company really did. The maiden name part anyway. Presumably I will have to go through all this again next year when the Co-op realise that they can make a killing by doubling their premiums too.

Little wonder that so many people are driving with no insurance. I would happily do so if it were not illegal to so much as own a vehicle and not insure it, let alone drive it.

***

Wheels of the Week Extra

SINCE we don’t have a picture with Wheels of the Week, here is a 1974 Rover P6, 2204cc.

Last week commenter Ivor MacAdam wrote: ‘I think the Rover P6 had the best “magic carpet” ride ever. Excellent styling, too. Apparently, they couldn’t make them quickly enough, sold like hot cakes.’