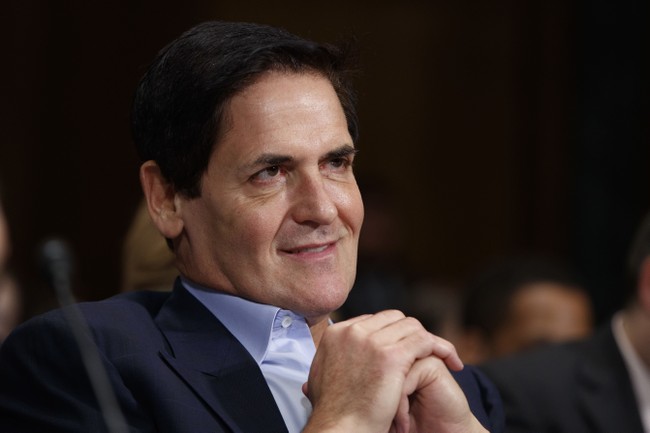

You may have heard that billionaire Mark Cuban recently claimed he knows DEI is effective because he can see it reflected in the bottom line. In other words, his companies which implement DEI have better earnings as a result. There’s actually a well known series of studies which claim to have demonstrated this relationship:

Four times in the past nine years, the business consulting firm McKinsey & Company has studied the relationship between corporate earnings and corporate diversity — the racial and ethnic makeup of their executives.

In all four reports, it found a statistically positive link: a more diverse company produces a higher return.

Two professors of accounting, Jeremiah Green of Texas A&M and John Hand of the University of North Carolina, set out to replicate McKinsey’s results. In a paper published last month in Econ Journal Watch, they found that they could not do so.

Dame Vivian Hunt, McKinsey’s managing partner in the UK and Ireland at the time and a coauthor on all four of McKinsey’s studies, crystalizes McKinsey’s view that greater racial/ethnic diversity in a firm’s executive team drives better firm financial performance: “What our data shows is that companies that have more diverse leadership teams are more successful. And so the leading companies in our datasets are pursuing diversity because it’s a business imperative and driving real business results”

…the goal of our paper is to revisit McKinsey’s results by means of a quasi-replication. We do so by applying McKinsey’s empirical testing approach to those firms that were in the S&P 500® Index on 12/31/19. We choose 12/31/19 so as to keep our quasi replication within the same pre-covid time window as McKinsey’s 2015, 2018, and 2020 studies. We focus on the large public US companies in the S&P 500® for two reasons. First, McKinsey would not provide us with their detailed datasets, nor the names of the firms in their datasets, so we were unable to directly replicate or investigate their analyses…

In contrast to McKinsey’s results, the key finding of our study is that we observe no statistically significant difference between the likelihood of financial outperformance as measured by the industry-adjusted EBIT margin of S&P 500® firms during the years 2015–2019 in the top vs. bottom quartiles of S&P 500® firms ranked on McKinsey’s executive racial/ethnic diversity metric measured in mid-2020.Instead, we find that 54.0 percent of S&P500® firms in the top executive race/ethnicity-ranked quartile have a positive industry-adjusted EBIT margin vs. 51.2 percent in the bottom quartile, with the z-statistic on the difference of 2.8 percent being a not statistically significant 0.5 (p-value = 0.65).

In conclusion, our results indicate that despite the imprimatur often given to McKinsey’s 2015, 2018, 2020, and 2023 studies, McKinsey’s studies neither conceptually (in terms of the correct direction of causality) nor empirically (in terms of their set of large US public firms) support the argument that large US public firms can expect on average to deliver improved financial performance if they increase the racial/ethnic diversity of their executives.

In a story about the study, the Washington Examiner pointed out this isn’t the only research that suggests DEI initiatives may not work as advertised.

Writing in the Harvard Business Review, Robin J. Ely, a professor of business administration at Harvard, and David A. Thomas, the president of Morehouse College, point out that “the rallying cries for more diversity in companies” are not supported “by robust research findings.” Ely and Thomas add, “We say this as scholars who were among the first to demonstrate the potential benefits of more race and gender heterogeneity in organizations.”

The idea that all these studies showing clear financial benefits to DEI are rubbish might be shocking to some readers, but it’s a familiar academic pattern. For well over a decade, scholars and media have publicly worried about the “replication crisis” in science. It turns out that an astonishing number of findings in various fields — from psychology and economics to sociology, medicine, and beyond — fail to hold up when other researchers attempt to replicate the findings, as Vox has explained.

I’ll just add that it’s rarely a good sign when the researchers involved in a study won’t turn over detailed information about their dataset. McKinsey should be willing to, at a minimum, hand over the names of firms examined in their studies to other qualified academics who want to check their work. The fact that they wouldn’t do so seems a bit suspicious.