The Autumn Statement at a glance:

BENEFITS above-inflation increase 6.7 per cent

PENSIONS above-inflation increase 8.4 per cent

HUNT’S public sector ‘improve productivity by 0.5 per cent pa’ request

OBR’S extraordinary fiscal numbers and growth forecast

THE veil has been lifted. In a remarkably candid, foolish or perhaps arrogantly dismissive article, depending on your take, the former Chancellor Philip Hammond has admitted what we all knew: that party politics and gaining perceived short term political advantage is far more important than running this place half sensibly. We, the electorate, are an afterthought to maintaining power.

I found the article published by the Telegraph particularly shocking. Talking about the process of delivering the Autumn Statement, Hammond boasts ‘I’m sure he [Jeremy Hunt] will do some laying of traps.’ The article then explains that the ‘Budget traps fall into two camps: political landmines that your opposition can step on before the election or, if the other side wins, hidden nasties that they will uncover long after you have left Downing Street.’

Hammond believed that Hunt would focus on the former and is quoted as saying, ‘It won’t be for a Labour government after the election. Nobody cares. If you lose the election, you don’t really care about that.’ In other words his government is more interested in political point-scoring than the careful long-term stewardship of the nation to which Chancellors are charged.

Yesterday’s Autumn Statement for sure falls into the elephant trap category. Of course Hunt has apparently delivered on the nirvana of tax cuts, but has he? Is it no more than a short-term expediency as the house slowly burns down? Has he not missed the point?

The problem is not tax: it comes from the complete failure of the government to control public spending and the Autumn Statement continues this trend with large above-inflation increases in state pensions, welfare benefits and a raft of other projects.

Tax is largely a derivative of spending. Cut spending and tax cuts will follow. The scale of increased spending, both today and in recent years, is extraordinary. If we take the long view, spending in real terms (after inflation) is up 85.3 per cent since the millennium and health spending has increased by a staggering 153 per cent. Even defence, where the scale of the forces is probably only around 60 per cent of the 2000 level, has seen a real 30 per cent rise in spending.

Where’s the money gone? Not one significant department has seen any austerity at all and growth has been steady, regardless of who has been in power. We live in a political world where saying yes is easy to this or that interest group, regardless of the greater good.

However, the real damage was done by lockdown with a staggering increase in spending, most of which is now embedded, resulting, without serious action, in permanently higher costs. Spending has increased by 30 per cent since 2019-20, or by some £160billion after accounting for inflation. That is unprecedented in peacetime and the results from this increased spending, I would wager most readers will suggest, are at best totally invisible and quite probably negative.

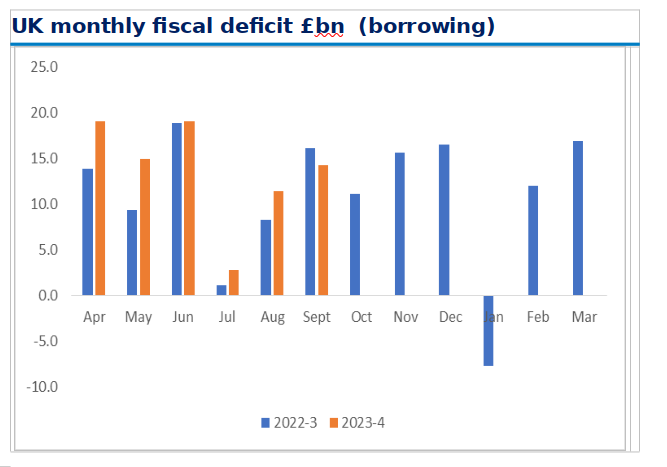

So despite the highest tax burden since 1948 the public finances remain in a shocking state. The Office for Budget Responsibility (OBR) seems to think there is headroom, but as you can see from the chart below, in five of the last six months borrowing is greater than the year before, which in itself was a very poor year. Headroom against the OBR’s incredible forecasts maybe, but not in the real world.

Source: ONS

In my judgement, the public finances remain in a highly parlous position. The OBR magically thinks that public spending growth will be minimal over the next four years. I am not sure how they work that out but that would be a remarkable turnaround from the current floodgate of spending, and unprecedented in an election year with a likely Labour Government thereafter.

Thus the OBR sees borrowing requirements falling sharply over the next four years. Our view would be, on a best case scenario, around £150billion of Government borrowing per annum from 2024-5. If our forecasts are right, this would leave the UK public finances at the very outer edge of credibility with little or no headroom for error. Remember this is on top of public debt increasing from around £500billion in 2005 to £2.6trillion today – a fivefold increase in less than 20 years!

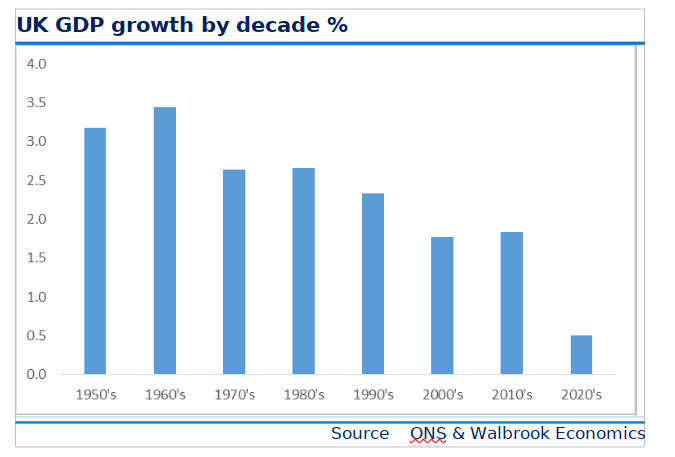

What is tragic is that the extraordinary growth of the state is killing the golden goose. The UK is well on the path to becoming a no-growth or worse economy, as outlined by the chart below that shows how GDP growth has deteriorated consistently over the last 50 years, despite all manner of technological improvements.

Indeed it’s rather worse than the chart suggests, for two primary reasons. That chart is absolute, but driven by unprecedented levels of migration the population is rising rapidly. The more important per capita growth level is very close to negative and has been for a number of years.

Moreover we have seen a real increase in public spending of some £160billion since 2019, or around 6 per cent GDP, taking the State to almost half of the entire output of the nation. Despite, or I would argue because of, this there has been almost no growth in the economy and thus by definition the private sector is in material recession and, in my view, has been thus for some time. To back this up, since lockdown the public sector headcount has increased by 626,000 while the private sector has shed 775,000 jobs!

With the exceptions of Greece and Spain, no European nation has been forced to put up tax like Britain since 2000. Forced to because Whitehall has completely lost control of spending. The contrast in fortunes between the UK and Ireland and Sweden, which have both moved in the opposite direction, cutting taxes materially over the last 20 years, could not be starker.

Yesterday Hunt cut some taxes and made platitudes towards improving truly lamentable public sector productivity. I say platitudes – he has asked for a whopping 0.5 per cent public sector productivity improvement per annum! That is not a typo – 0.5 per cent. Frankly, his proposals are far too little and not backed up with any real endeavour to reduce the absurd reach of the State. It is tax, spend and regulation that is killing the golden goose.

As things stand, the state has grown from a third of the economy to almost half today with a commensurate private sector decline. This over-estimates private sector performance as whole swathes of the economy from energy supply to banking, from employment law to ESG (Environmental, Social, and Governance) and many more, are now micro regulated greatly reducing competitiveness, adding to inflation and reducing productivity. Nothing in yesterday’s statement addresses this core challenge.

The British tragedy is that until recently there was a party that broadly believed in the individual, free markets and personal choice, and there was another party who believed in re-distribution, centralisation and control. Today there is a party who act as if they believe in re-distribution, centralisation and control, and another party who believe it sincerely and will take it to another level. This is a disaster for the country, resulting in the most unhealthy consensus and little pushback to the continuous ratchet of yet more spend and state control.

In meetings with clients, the most optimistic view Britain as the new Italy without the beautiful architecture, ie a country in structural decline. The pessimists believe we are in the late early stages of following the same delusion as numerous Argentinian governments who took one of the most successful and prosperous nations on earth to abject destruction over 60-odd years. They achieved that through delusional spending, re-distribution, printing money and weak ‘yes’ politicians.

So, super, a few tax cuts! And super talk of improving productivity, but 0.5 per cent – is that really the best you can do? Without genuine and urgent action to improve public sector productivity and repurpose the state back to recent norms the UK is on a debt spiral which can only be described as very dangerous indeed.