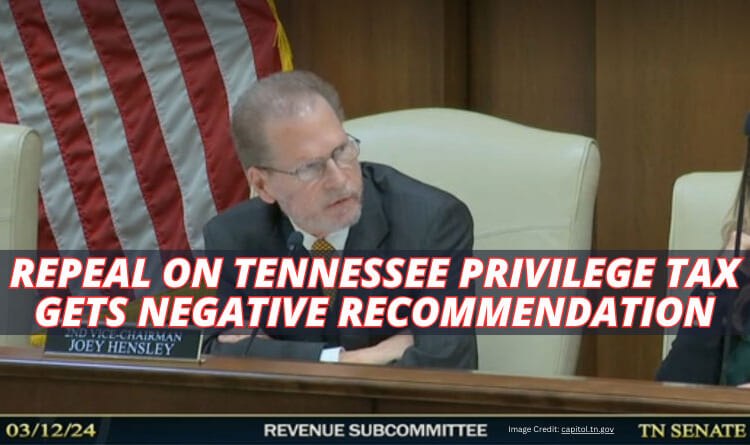

Image: Sen. Joey Hensley, Senate Revenue Subcommittee chair Image Credit: capitol.tn.gov

The Center Square [By Jon Styf] –

A bill that would end Tennessee’s professional privilege tax advanced through subcommittee with a negative recommendation on Tuesday.

Tennessee currently charges individuals in five professions $400 annually. Those professions include lobbyists, attorneys and agents, broker-dealers and investment advisors.

The professional privilege tax was instituted in 1992 for 22 different professions and currently applies to just five professions.

Tennessee last removed professions from the tax in 2022.

“Sponsor, we all want to get rid of the tax but probably this year is not the year to do it,” said Sen. Joey Hensley, R-Hohenwald, the Senate Revenue Subcommittee chair.

Senate Bill 1944 was given a negative recommendation because it would cost the state $86.5 million annually starting with the tax year that ends on May 31, 2026.

Tennessee currently pays the professional privilege tax for 2,061 state employees.

About the Author: Jon Styf, The Center Square Staff Reporter – Jon Styf is an award-winning editor and reporter who has worked in Illinois, Texas, Wisconsin, Florida and Michigan in local newsrooms over the past 20 years, working for Shaw Media, Hearst and several other companies. Follow Jon on Twitter @JonStyf.