Image Credit: capitol.tn.gov

The Tennessee Conservative Staff –

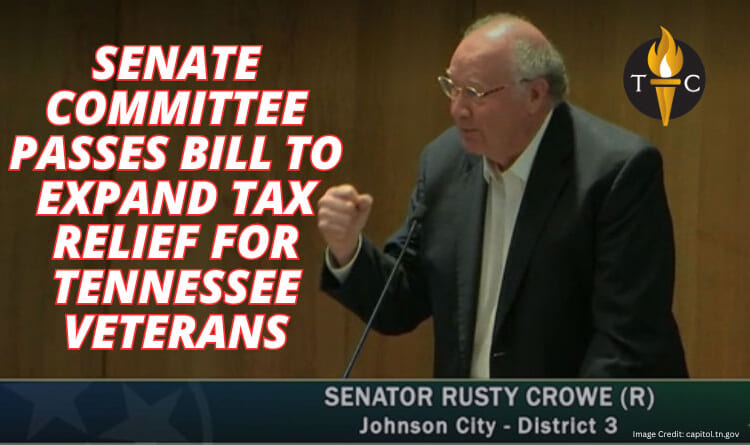

A bill that would expand eligibility for property tax relief to more of Tennessee’s disabled veterans was passed in the Senate State and Local Government Committee on March 12.

Senator Rusty Crowe (R-Johnson City-district 3) is the sponsor of Senate Bill 1725 (SB1725), which is written to assist more individuals who have sacrificed by serving their country.

Senate Bill 1725 – “As introduced, expands eligibility for property tax relief to a veteran who acquired a service-connected disability that is determined by the United States Department of Veterans Affairs to be permanent and total due to individual unemployability. – Amends TCA Section 67-5-704.”

State law currently requires that individuals be considered to be 100% disabled to qualify; however, the VA currently considers veterans who are 60-80% disabled but are unemployable to be 100% disabled. The updated legislation would allow those determined to be 100% by the VA to receive the tax relief.

Crowe noted the large fiscal note of $10-$11 million dollars but stated that he felt it was important to provide this relief for those veterans.

Chairman. Richard Briggs (R-Knoxville-District 77) asked for a roll call vote on the bill. It passed unanimously in the committee.

The bill has been referred to the Senate Finance, Ways, and Means Committee but has not appeared on their calendar upon publication of this article.