Photo: Fedex owns over $800 million worth of property, according to Shelby County bond records. Photo Credit: John Partipillo

By Adam Friedman [Tennessee Lookout -CC BY-NC-ND 4.0] –

Nissan, FedEx, Brown-Forman (the owner of Jack Daniels) and Eastman Chemical each control over $500 million worth of assets in Tennessee, making them the most likely beneficiaries of Gov. Bill Lee’s plan to change the state’s business property tax.

The most valuable assets controlled by those four companies and dozens of others are available to the public because bond documents require counties to list their 10 largest property asset taxpayers. The records don’t provide a complete picture of every asset a company owns and exemptions in the state’s records laws prevent the public from knowing how much corporations pay in taxes.

But bond documents, compiled by the Lookout from over a dozen counties and cities home to state’s largest companies, provide one of the few public avenues to see which corporations might benefit from the Lee administration’s plan to fix what they see as a legal liability in the state’s business tax related to the value of property a company has in Tennessee. The plan is to eliminate the property portion of the state’s business tax, called the franchise tax, and offer $1.2 billion in refunds to corporations for taxes deemed “wrongly paid” by the administration.

Experts have disagreed on whether the change that Lee is pushing is necessary, instead pointing out that it’s more likely a way to justify enacting another corporate tax cut after doing so last year.

State officials told reporters at a budget briefing earlier this month no company has sued the state over its business tax collections but around 80 have requested refunds. Sen. Bo Watson, R-Hixson, the chair of the Senate finance committee, estimated 100,000 companies would receive a refund.

Despite no official lawsuit, the Lee administration recommended in this year’s budget that lawmakers should cut the tax for future years, costing $410 million annually, and refund around three years of past collections.

This move to preempt a lawsuit is unprecedented in Tennessee, which regularly fights challenges to its tax system. Revenue Commission David Gerregano told lawmakers on the Senate finance committee in a memo that the state is currently disputing eight different tax challenges, but none would be as costly as a potential business tax suit.

The Revenue Department has provided reporters with few details on how the state came to believe its corporate tax, which has existed for several decades, is no longer legal. The department based the legal liability on a 2015 U.S. Supreme Court ruling dealing with an income tax in Maryland, adding the state attorney’s general office recommended the refunds and cuts.

Using a public records exemption, the Department of Revenue denied a request made by the Lookout for communications discussing the tax cut. The department also refused to release the names of 80 companies requesting a refund, first reported by The Tennessean.

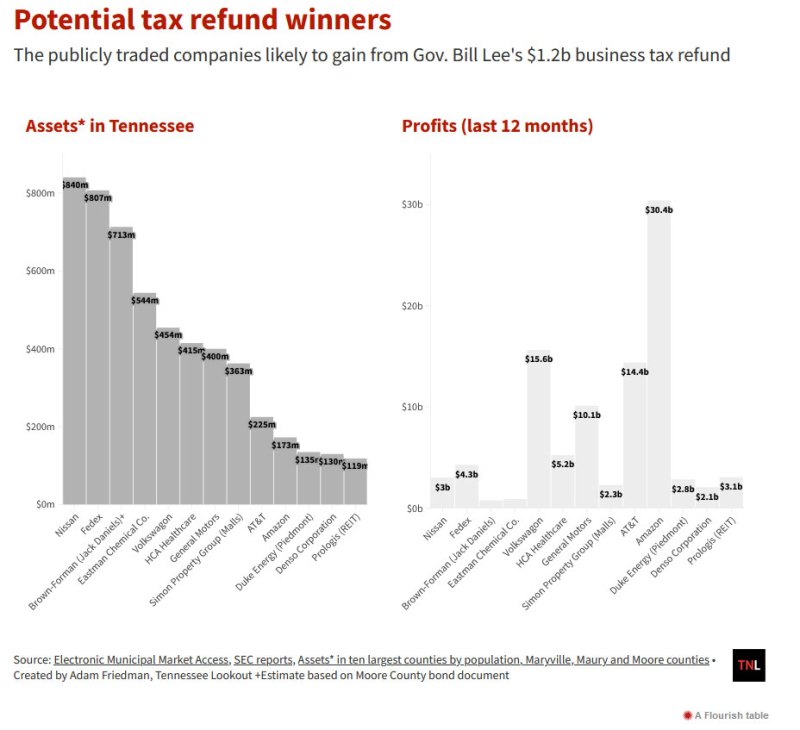

The methodology behind the chart

Looking through 13 county and city bond documents, the Lookout created a list of 106 unique companies with $14 million to $839 million in assets in Tennessee.

The Lookout chose to look at the 10 largest counties in Tennessee by population and bonding documents in Maryville, Maury and Moore counties. All the records were from 2018 or later.

The decision to add the last four counties and cities was based on finding the most up-to-date information available and public knowledge about large industrial plants like General Motors Spring Hill facility in Maury County, the Jack Daniels distillery in Moore County, and Denso’s manufacturing facility in Maryville.

The property value of the property owned by Jack Daniels parent company had to be estimated based on the taxes they pay.

Of those 92 companies, the Lookout narrowed its list to 13 companies with over $100 million in assets and publicly traded on a U.S. stock exchange.

It’s impossible to calculate the potential refund for these companies because they will have to pay some form of a corporate tax, just less with the cut.

The 13 publicly traded companies that appear on the above chart could also own more assets than appears on the top 10 taxpayers in those reports. But U.S. Security and Exchange Commission records show that all the corporations on the list were profitable over the past year. Combined the companies made $84.9 billion in profit, ranging from $894 million to $30.4 billion.

Sam Stockard contributed to this report.