Don’t you love it when a plan comes together?

Just like we drew it up. pic.twitter.com/9NBvc5nVZE

— Joe Biden (@JoeBiden) February 12, 2024

This preening group of pathetic amateurs sure think they do.

If only the tubers running our government had one. I’d even settle for any of them having a clue, but that would be one functioning brain stem too far.

NEW: On Super Bowl Sunday, President Biden complains about Bidenomicspic.twitter.com/fmskoisuP2

— Breaking911 (@Breaking911) February 11, 2024

You bet there’s a disconnect, POTATUS. Somehow we simple-minded Americans aren’t falling for the line blaming the big, mean companies for everything.

Sometimes, it’s the people in charge whose policy decisions – or lack thereof – facilitate the shrinkflation thanks to administrative policy-induced inflation. And no matter how you beat Americans over the head whining about a smaller bag of potato chips or fewer chips in your shockaship cookie being the fault of manufacturers, we’re the ones who get to experience paying for all of it. Or less of it.

We know what it’s been like out here in the real world, and all the smoke blowing you and the toadies do doesn’t change the fact that y’all own this mess.

“Proof’s in the pudding” as they say.

… yet a Big Mac Meal costs $18.

Sorry, 10% For The Big Guy, but #Bidenomics has resulted in the worst economy for working families in decades, and no amount of gaslighting by you or the rest of the Democrat/Media Complex will alter the reality we see in our local grocery store…

— Cynical Publius (@CynicalPublius) February 10, 2024

Especially your repeated assurances inflation is practically non-existent. Corporations are merely greedy, sneaky, product-shrinking bastards, and Americans are never satisfied whiners.

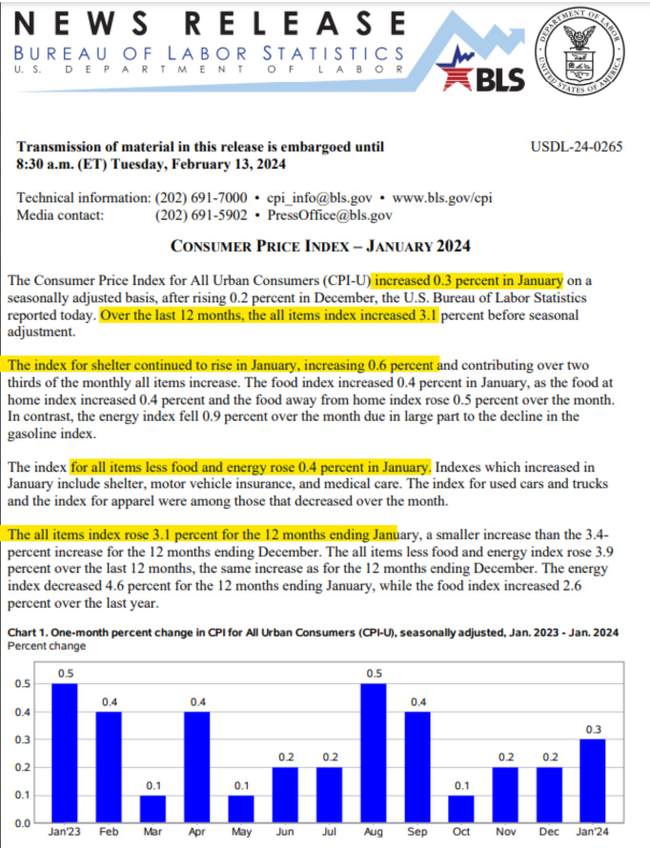

Well, the Bureau of Labor Statistics (BLS) released the core inflation number or the Consumer Price Index (CPI) this morning, and YOICKS.

Let’s just say Jerome and Janet’s machinations coupled with POTATUS’ big spending has overshot the mark. Things are still *gulp* looking up, which means they’re pretty much gonna suck for us who have to pay rent, car insurance, feed ourselves, etc. ad nauseum – things that life requires. Eke out a living in the wonder that is #Bidenomics.

Oh, hi.

I don’t think the Fed can pivot here. This is what 3.9% YoY core inflation over the last 50 years looks like. It’s a huge burden on American households. https://t.co/7DoT5UeCAc

— David Sommers (@dgsommersmkts) February 13, 2024

All the analysts are saying the only thing that saved this number from being a brutal blowout?

Oil prices. Kiss a fracker. Despite everything this administration has done to make life difficult and shut them down, the fact is that the American oil and gas industry has been humming along in the face of global disruptions and domestic resistance, which has kept those prices within moderation.

Again, the only thing “helping” inflation is energy. A warm winter in the northeast helped.

Transportation Services (the cost of going and getting stuff to places) skyrocketing.

Policy can fix this.. the only way the Fed does it is by massive recession.

Buckle up… pic.twitter.com/HKgU5ujhbt— Frog Capital (@FrogNews) February 13, 2024

Worth considering the role that energy played in anchoring January’s inflation read. Oil prices so far have shrugged off the conflict in the Middle East. If that was to change and energy costs jumped, it would complete the trifecta for households — food, shelter and energy costs would all be higher. There’s a lot riding on the energy component.

Consider that we have a fumbling, pugnacious White House that is openly hostile to the one sector working for us right now.

HOLY SMOKES

As for other sectors?

AI DIOS MIO

Buried in the category numbers are figures any shopper could tell WH tubers if they were interested. STill, it’s nice to see validation in official numbers, even if it hurts.

Out of hundreds of line items, the single one with the highest inflation rate was “other condiments,” up 6.9% in January. It’s not entirely clear what that category includes, though we know it’s not salt, spices, olives, pickles, relishes, sauces or gravies.

I just paid through the nose for some mayonnaise, so this rings true. That makes sense, too, since its chief ingredient, eggs (No. 4 category for inflation this month), rose 3.4% in January.

Yeah. Food prices. Shockaship cookies and ice cream – but we’re the ones who are “disconnected.”

Following on Enda’s observation on the political ramifications, the narrative for some months now has been that consumers just need time to forget the price shock from 2021-22. As time goes on, and wages rise, they’ll just sort of amortize the cost-of-living increase. But with grocery bills heading higher again, the risk is that consumers keep getting reminded of that shock. That’s obviously bad for the incumbent.

What the WH tubers consistently miss is that the ‘price shock” we’re supposed to forget has NEVER gone away – they’ve just built on it at a slower pace. It can’t be forgotten because we’re still dealing with it. Hardly a thing’s gone anywhere near back to what it cost when these fools took office, and I don’t believe anyone remotely expected that, being rational individuals ourselves. But we don’t also expect to be piled on month after month, which is what has happened. And then lied to about it. We can do math.

Inflation looks even stronger when considering supercore prices. This is the category that the Fed keeps a close eye on and represents core service prices minus housing. CPI on that basis reaccelerated to a 4.3% pace from the prior year, the fastest since May. The monthly pace also rose. It is up 0.85%, the hottest since April 2022!

Car insurance is up 20.6% year over year – and don’t I know it. Electrical rates rose at the fastest since July of 2022. Housing came in up .6% – people are trapped in their homes by the rise in mortgage rates, and rents are spiking thanks to shortages. New shelter construction is expensive, thanks to inflation for materials and? Those financing rates.

Snek meet tail.

We’re not imagining it at all. It’s piling on. And remember, this is just one month – January ’24.

1. Car Insurance Inflation: 20.6%

2. Transportation Inflation: 9.5%

3. Hospital Services Inflation: 6.7%

4. Car Repair Inflation: 6.5%

5. Homeowner Inflation: 6.2%

6. Rent Inflation: 6.1%

7. Food Away From Home Inflation: 5.1%

It’s also an election year, and while a Fed rate cut had been priced in as early as March – which this has blown out of the water – there is still hope that the numbers will ease enough that Jerome Powell and the board will do so by May. Any later, and there can be accusations of election-year favors to POTATUS, even though the Fed is painted as a politically disinterested actor. It will be uncomfortable as data and time begin to squeeze them.

If this is a one-off reading, the administration can brush it off as an aberration. Or revise it away, as they do with so many other inconvenient statistics. But if these numbers hold up and continue, even for the next few months…

Chris and Enda posted earlier about the political ramifications of CPI picking up, and it looks like nearly all major basic categories for consumers increased at a faster pace or stayed firm in January.

While gas prices decelerated, electricity bills were higher. Grocery prices were higher, particularly for dairy, fruits and vegetables, and beverages. (Dining out was also pricier). Shelter prices reaccelerated. Used car prices eased, but the price to insure a car was higher. Daycare and tuition prices increased at a faster pace.

…I don’t think this administration has enough lipstick for the pig they’ve created and not nearly enough intellectual firepower to apply it effectively.

They haven’t so far.